Independent Contractor: Definition, How Taxes Work, and Example

Por um escritor misterioso

Last updated 20 setembro 2024

:max_bytes(150000):strip_icc()/independent-contractor.asp-FINAL-6904c017dfbf4da18e90cf4db4af91e7.png)

An independent contractor is a person or entity engaged in a work performance agreement with another entity as a non-employee.

:max_bytes(150000):strip_icc()/how-to-report-and-pay-independent-contractor-taxes-398907-FINAL-5bb27d1846e0fb0026d95ba3.png)

Tax Guide for Independent Contractors

Guide to Taxes for Independent Contractors (2023)

:max_bytes(150000):strip_icc()/TaxableIncome_Final_4188122-0fb0b743d67242d4a20931ef525b1bb1.jpg)

Taxable Income: What It Is, What Counts, and How To Calculate

What does an employee lose when they work as an 'independent

Employee misclassification penalties: Examples and protections

Insurance Review of Independent Contractors Risk and Insurance

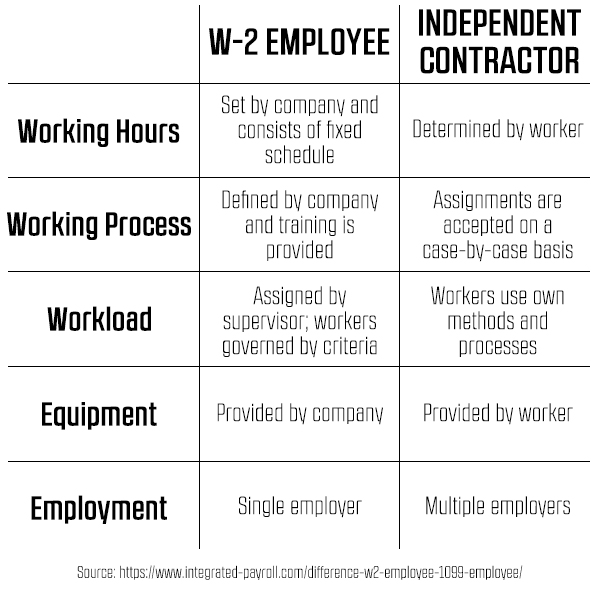

Do You Need a W-2 Employee or a 1099 Contractor? - How to Start

1099 vs W-2: What's the difference?

Payroll tax - Wikipedia

Self-Employment Tax: Everything You Need to Know - SmartAsset

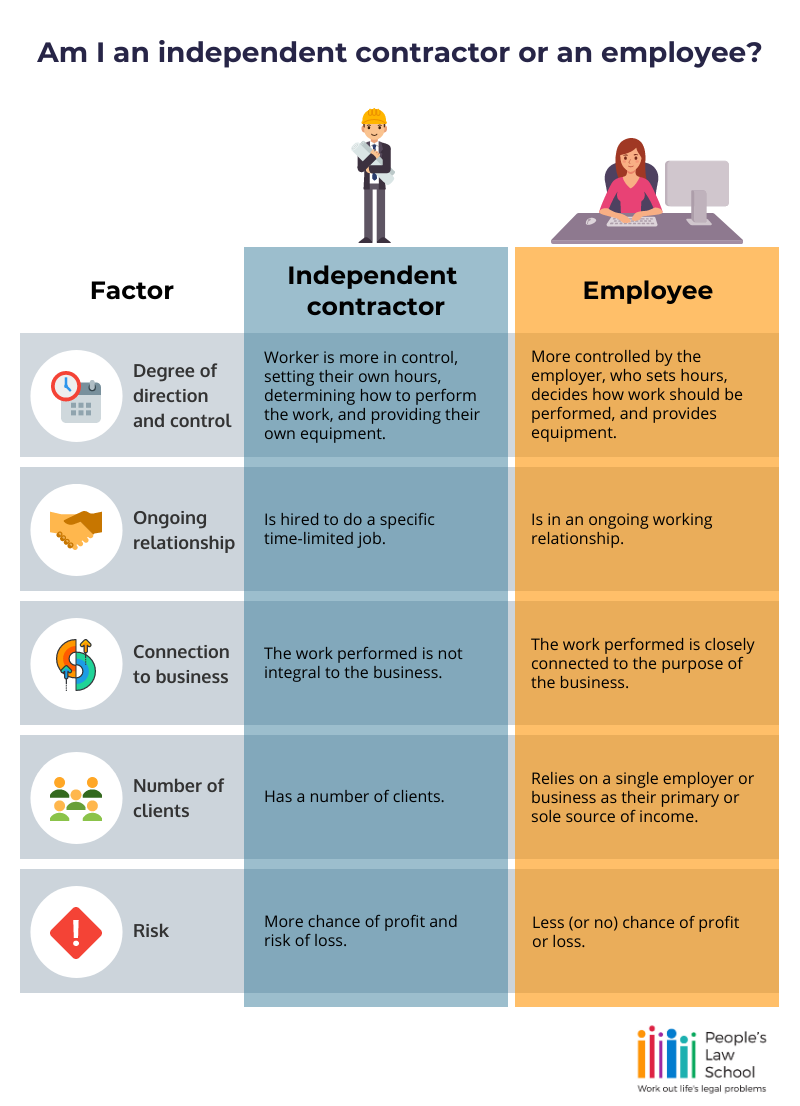

Are you an independent contractor?

:max_bytes(150000):strip_icc()/Form-1099-INT-f66ad58588f44ad6a46c69545056753a.jpg)

What Are 10 Things You Should Know About 1099s?

:max_bytes(150000):strip_icc()/freelancer.aspfinal-735c7be9a7d642eabcafa5a0117e4823.jpg)

What Is a Freelancer: Examples, Taxes, Benefits, and Drawbacks

Recomendado para você

-

What does your name mean according to urban dictionary? - Quora20 setembro 2024

-

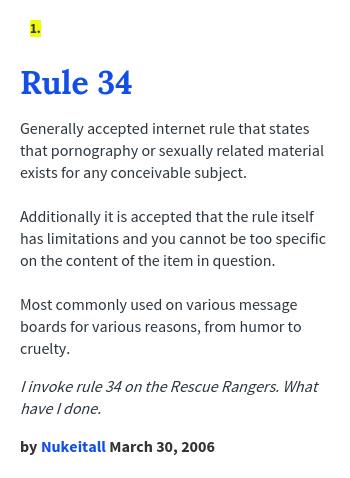

Urban Dictionary on X: @Ac1d_Ra1n_ Rule 34: Generally accepted internet rule that states that pornog / X20 setembro 2024

Urban Dictionary on X: @Ac1d_Ra1n_ Rule 34: Generally accepted internet rule that states that pornog / X20 setembro 2024 -

The Kpop Dictionary: 500 Essential Korean Slang Words and Phrases Every Kpop Fan Must Know20 setembro 2024

The Kpop Dictionary: 500 Essential Korean Slang Words and Phrases Every Kpop Fan Must Know20 setembro 2024 -

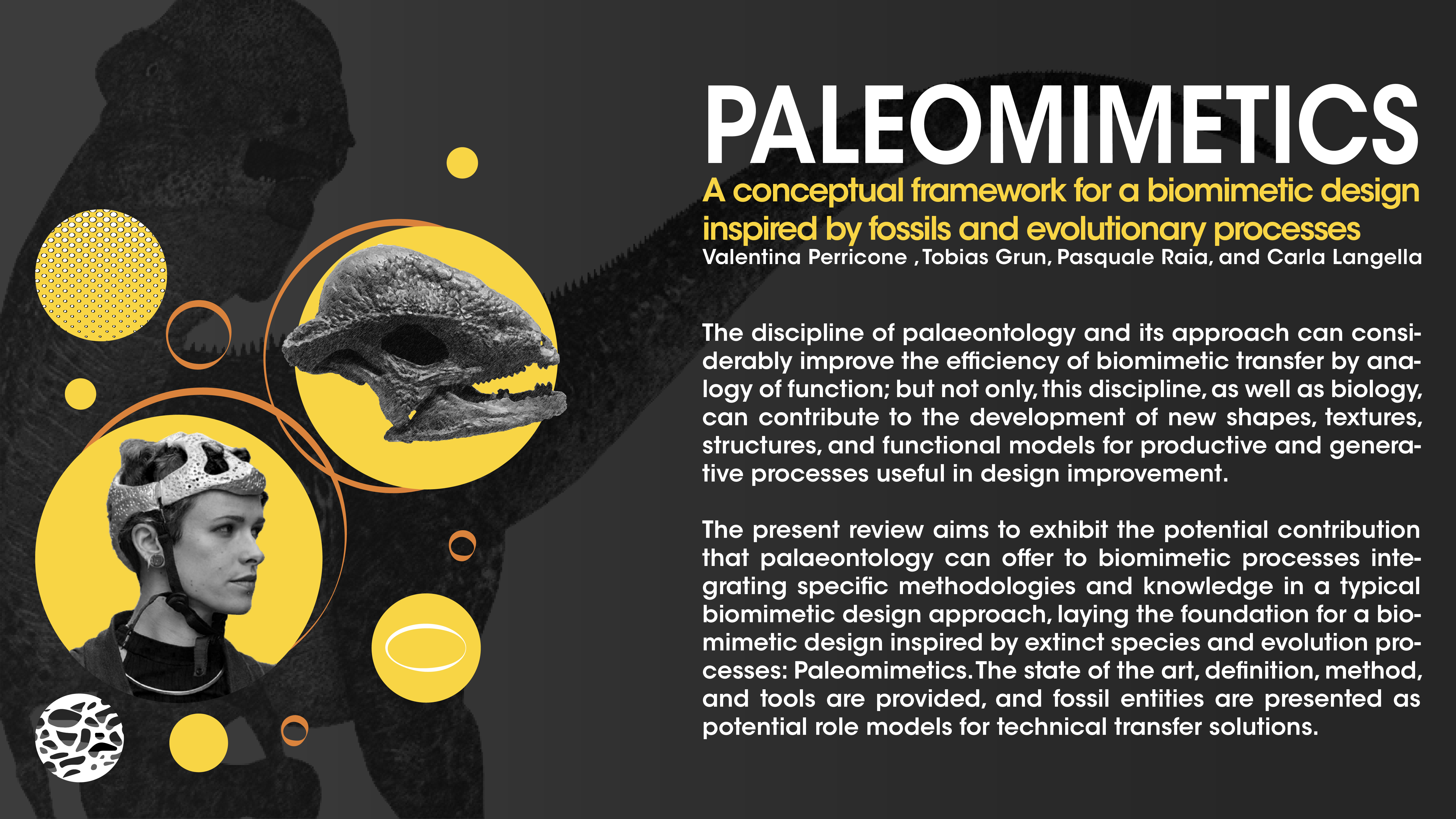

Biomimetics, Free Full-Text20 setembro 2024

Biomimetics, Free Full-Text20 setembro 2024 -

Deference (administrative state) - Ballotpedia20 setembro 2024

Deference (administrative state) - Ballotpedia20 setembro 2024 -

The American Home Front and World War II (U.S. National Park Service)20 setembro 2024

The American Home Front and World War II (U.S. National Park Service)20 setembro 2024 -

15-minute city - Wikipedia20 setembro 2024

15-minute city - Wikipedia20 setembro 2024 -

:max_bytes(150000):strip_icc()/retailbanking.asp-final-3474e513dbcb47919f81e440ffde237d.png) Retail Banking: What It Is, Different Types, Common Services20 setembro 2024

Retail Banking: What It Is, Different Types, Common Services20 setembro 2024 -

Religions, Free Full-Text20 setembro 2024

Religions, Free Full-Text20 setembro 2024 -

The Sense of Style: The Thinking Person's Guide to Writing in the 21st Century: Pinker, Steven: 9780143127796: : Books20 setembro 2024

The Sense of Style: The Thinking Person's Guide to Writing in the 21st Century: Pinker, Steven: 9780143127796: : Books20 setembro 2024

você pode gostar

-

FIFA 21: Como conseguir el SBC de Rhian Brewster Future Stars, requisitos, precio y recompensas - Millenium20 setembro 2024

FIFA 21: Como conseguir el SBC de Rhian Brewster Future Stars, requisitos, precio y recompensas - Millenium20 setembro 2024 -

Name That Tune - Watch on FOX20 setembro 2024

Name That Tune - Watch on FOX20 setembro 2024 -

A 41 year-old read-out and the true purpose of Microsoft Solitaire20 setembro 2024

A 41 year-old read-out and the true purpose of Microsoft Solitaire20 setembro 2024 -

Hikari no Ou Iris (Shironeko Project: Zero Chronicle) แฟนพันธุ์แท้, อะนิเมะ20 setembro 2024

Hikari no Ou Iris (Shironeko Project: Zero Chronicle) แฟนพันธุ์แท้, อะนิเมะ20 setembro 2024 -

Steve Maccoy20 setembro 2024

-

Black Friday no Bob's tem milk shake por R$ 5,9020 setembro 2024

Black Friday no Bob's tem milk shake por R$ 5,9020 setembro 2024 -

Roblox event icon (Up) by TheTingDosentGoPaPa on DeviantArt20 setembro 2024

Roblox event icon (Up) by TheTingDosentGoPaPa on DeviantArt20 setembro 2024 -

Alan Cohen - Center for American Progress20 setembro 2024

Alan Cohen - Center for American Progress20 setembro 2024 -

Attempt at making John the Otter in Gacha Club by rashboy -- Fur20 setembro 2024

Attempt at making John the Otter in Gacha Club by rashboy -- Fur20 setembro 2024 -

Alphabet lore baby - Comic Studio20 setembro 2024

Alphabet lore baby - Comic Studio20 setembro 2024