Itemize - Home

Por um escritor misterioso

Last updated 21 setembro 2024

Itemize automates B2B financial document processing, enhances risk assessment, and helps approve transactions via streamlined information flows and improved business intelligence.

Tax Breaks from Buying a House

Itemize - Home

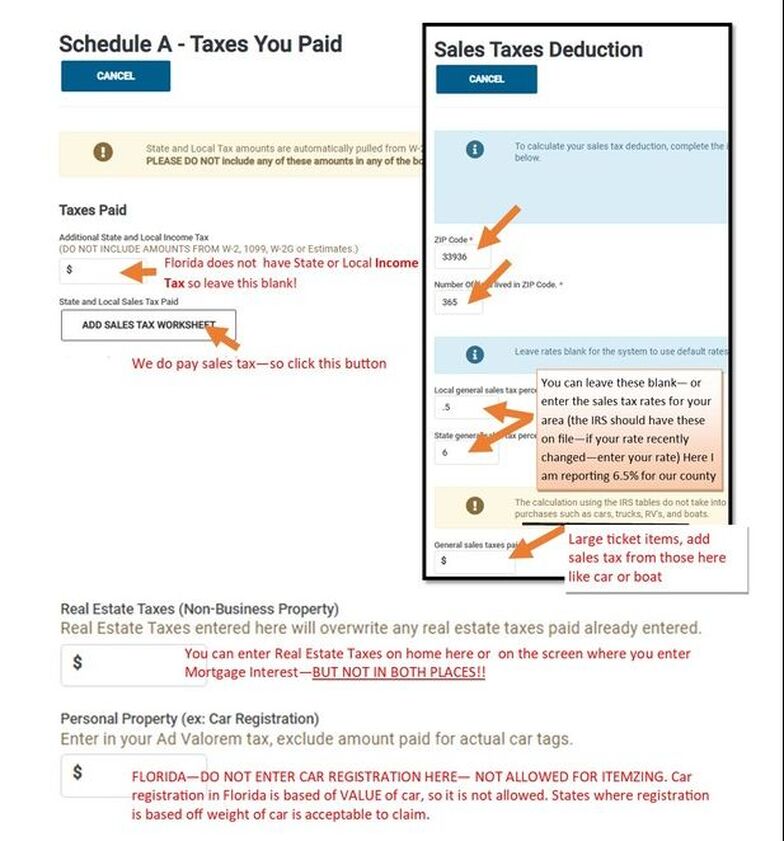

Itemize deductions

Are Home Improvements Tax Deductible?

Simplified Home Office Deduction: When Does It Benefit Taxpayers?

Why Have a Design And Pricing Meeting? Custom Home Builders - Schumacher Homes

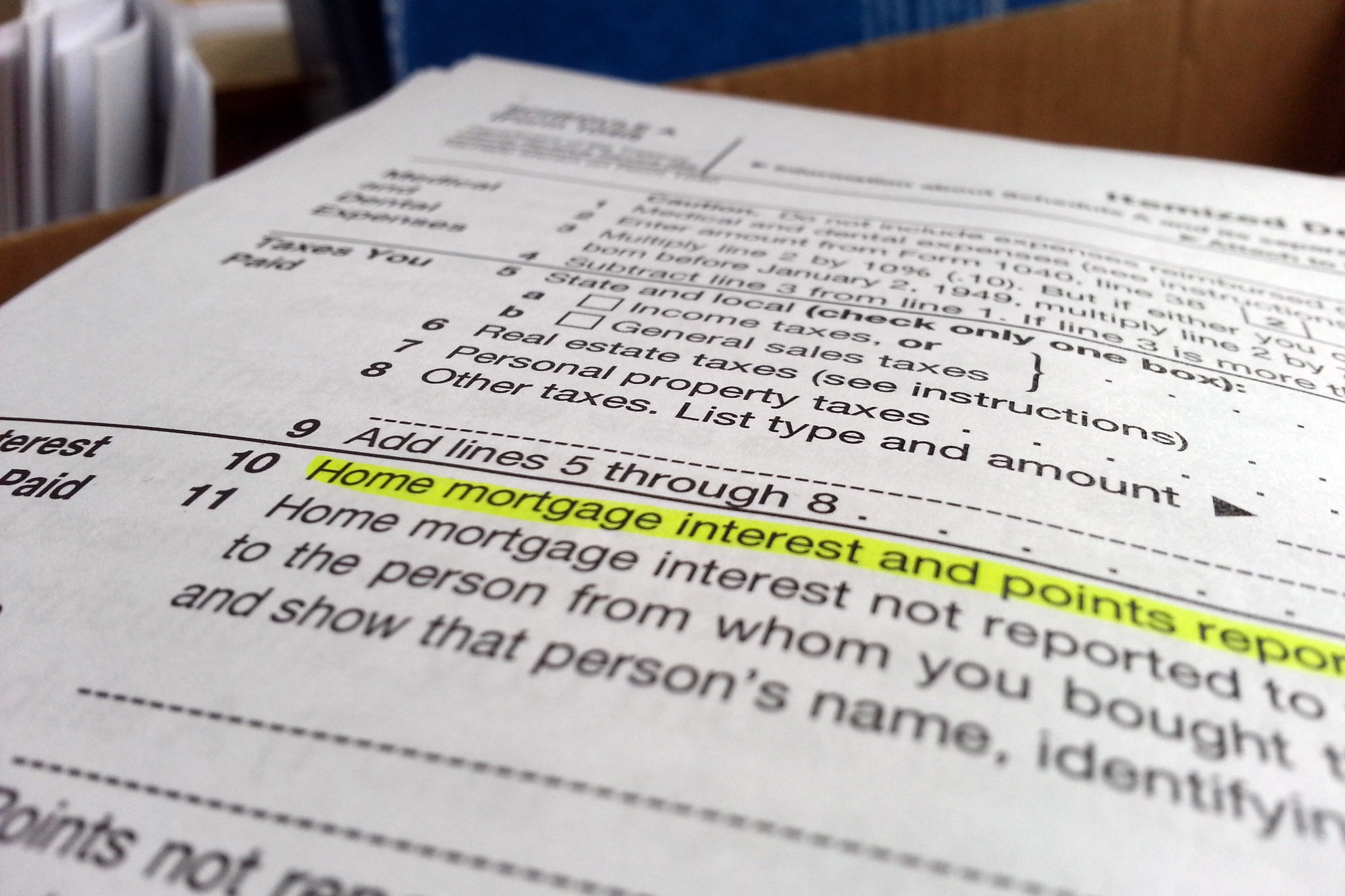

Mortgage Points Deduction, Itemized Deductions

Home-based S-Corps – how shareholders can deduct home office + personal car use

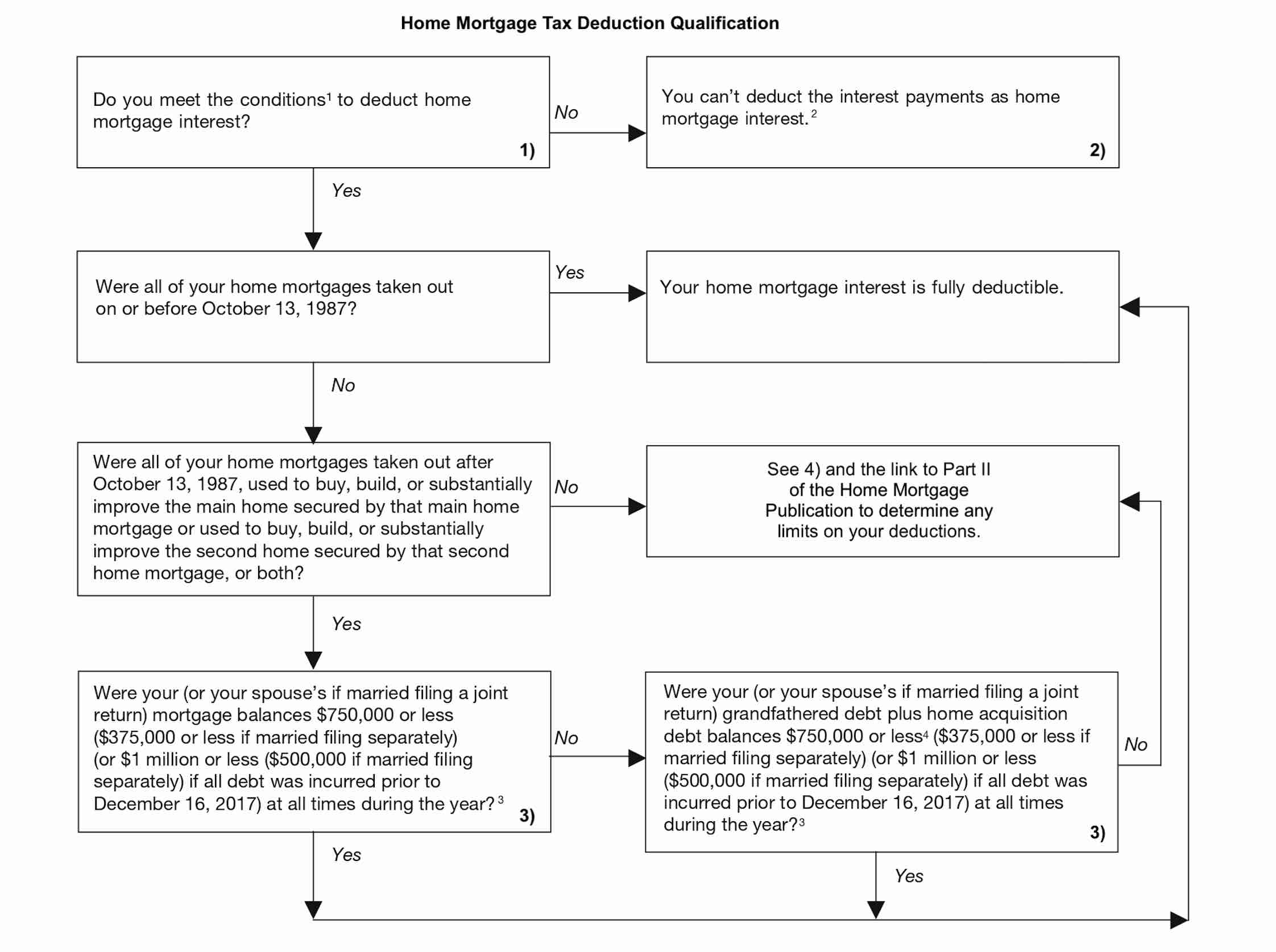

✓ Home Mortgage Interest Tax Deduction Qualification

Are Home Improvements Tax-Deductible? The Rules Explained, with Examples

Get a Tax Credit for Buying a House

Do existing tax incentives increase homeownership?

FHA 203K Loan - How Much it Costs to Renovate a Home (Detailed Contractor Example) - Black Real Estate Agents

Should I Itemize My Tax Deductions or Take the Standard Deduction?

Recomendado para você

-

AutoNation Portal21 setembro 2024

-

AP Automation & Audits Fight Fraud - Stampli21 setembro 2024

AP Automation & Audits Fight Fraud - Stampli21 setembro 2024 -

What Is an Invoice Payment? How It Works & Tips From Experts21 setembro 2024

What Is an Invoice Payment? How It Works & Tips From Experts21 setembro 2024 -

3-Way Match and Accounts Payable • MHC21 setembro 2024

3-Way Match and Accounts Payable • MHC21 setembro 2024 -

Invoice Number — What You Need to Know21 setembro 2024

Invoice Number — What You Need to Know21 setembro 2024 -

Duplicate Invoice Check Part 1, PDF, Invoice21 setembro 2024

-

Rukmani R on LinkedIn: How Credit Note can be processed? 1.Make sure you are receiving proper…21 setembro 2024

-

AI invoice processing: How to leverage AI in AP Automation21 setembro 2024

AI invoice processing: How to leverage AI in AP Automation21 setembro 2024 -

Invoicing: Get paid on time with eInvoicing21 setembro 2024

Invoicing: Get paid on time with eInvoicing21 setembro 2024 -

Invoice with check mark and cross sign on mobile phone screen21 setembro 2024

Invoice with check mark and cross sign on mobile phone screen21 setembro 2024

você pode gostar

-

Premium AI Image Pixar's Captivating Oceanic Animation A Dive21 setembro 2024

Premium AI Image Pixar's Captivating Oceanic Animation A Dive21 setembro 2024 -

Watch Afro Samurai - Free TV Shows21 setembro 2024

Watch Afro Samurai - Free TV Shows21 setembro 2024 -

![Stickman Dismounting v3.1 Apk Mod [Dinheiro Infinito]](https://www.androgado.com/wp-content/uploads/2021/08/Stickman-Dismounting-hack-download.jpg) Stickman Dismounting v3.1 Apk Mod [Dinheiro Infinito]21 setembro 2024

Stickman Dismounting v3.1 Apk Mod [Dinheiro Infinito]21 setembro 2024 -

Boneco Pokemon Figura Pikachu 10cm Vinil 2600 Sunny – Papelaria Pigmeu21 setembro 2024

Boneco Pokemon Figura Pikachu 10cm Vinil 2600 Sunny – Papelaria Pigmeu21 setembro 2024 -

Giga Chad - song and lyrics by Day by Dave21 setembro 2024

-

Mascote macaco engraçado e muito fofo - Animais Cortar L (175-180CM)21 setembro 2024

Mascote macaco engraçado e muito fofo - Animais Cortar L (175-180CM)21 setembro 2024 -

Como você morreu na sua vida passada?21 setembro 2024

Como você morreu na sua vida passada?21 setembro 2024 -

Motocross - Desenho de finrodfelagund - Gartic21 setembro 2024

Motocross - Desenho de finrodfelagund - Gartic21 setembro 2024 -

Começou a pré-venda de God of War Ragnarök - Drops de Jogos21 setembro 2024

Começou a pré-venda de God of War Ragnarök - Drops de Jogos21 setembro 2024 -

anime #animesadmoment #animesbrasil #animesad #Anime #animes #animere21 setembro 2024