Publication 970 (2022), Tax Benefits for Education

Por um escritor misterioso

Last updated 16 setembro 2024

Publication 970 - Introductory Material Future Developments What's New Reminders

Tax Information - Spartan Central

Educational Tax Credits and Deductions You Can Claim for Tax Year 2022, Taxes

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

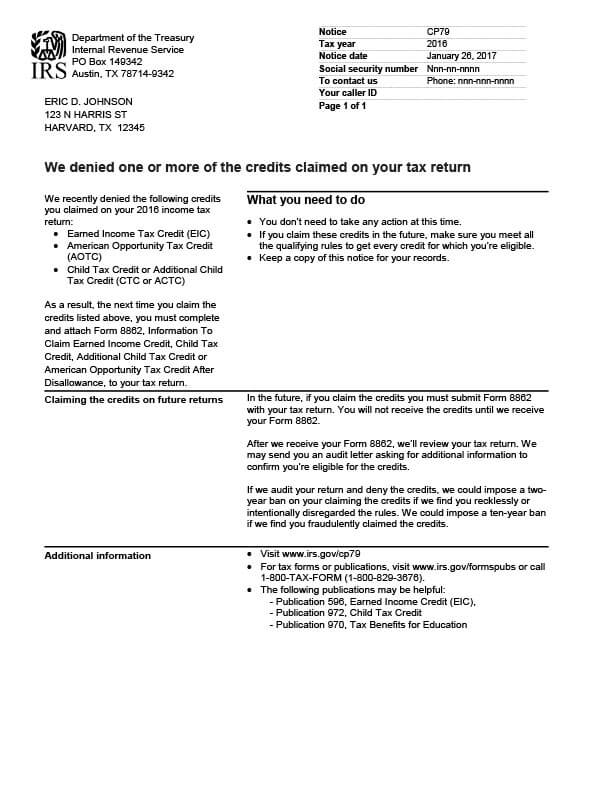

IRS Notice CP79 - Tax Defense Network

Education Tax Credits – Get It Back

Coverdell Education Savings Account: Exploring the Details in IRS Pub 970 - FasterCapital

New 2022 IRS Income Tax Brackets And Phaseouts For Education Tax Breaks

Tax Credits For Higher Education

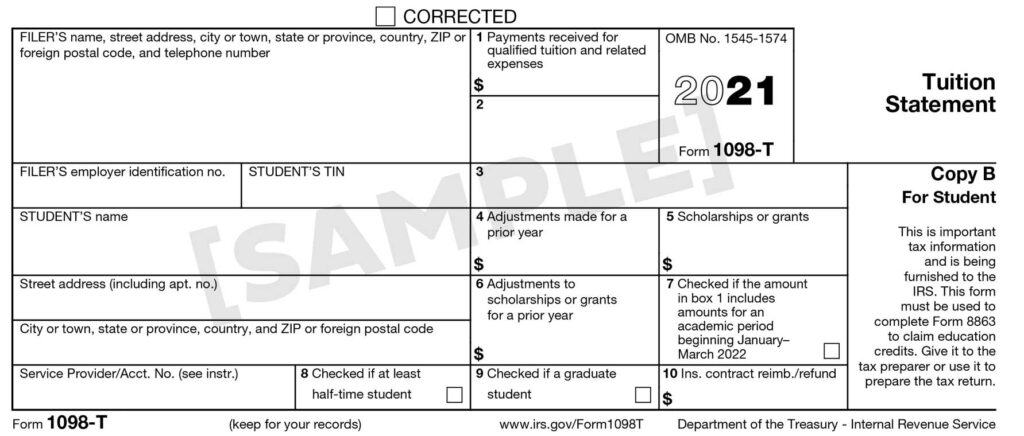

How to Interpret the 1098-T

New school year reminder to educators; maximum educator expense deduction is $300 in 2023

All the Money-Smart Freebies - Financial Freedom Evolution

Recomendado para você

-

Back to School - Oryu - Webtoons - Lezhin Comics16 setembro 2024

Back to School - Oryu - Webtoons - Lezhin Comics16 setembro 2024 -

Back to School Webtoon Review – ejstories16 setembro 2024

Back to School Webtoon Review – ejstories16 setembro 2024 -

Back to School - Chapter 1 - Page 4 by PlayboyVampire on DeviantArt16 setembro 2024

Back to School - Chapter 1 - Page 4 by PlayboyVampire on DeviantArt16 setembro 2024 -

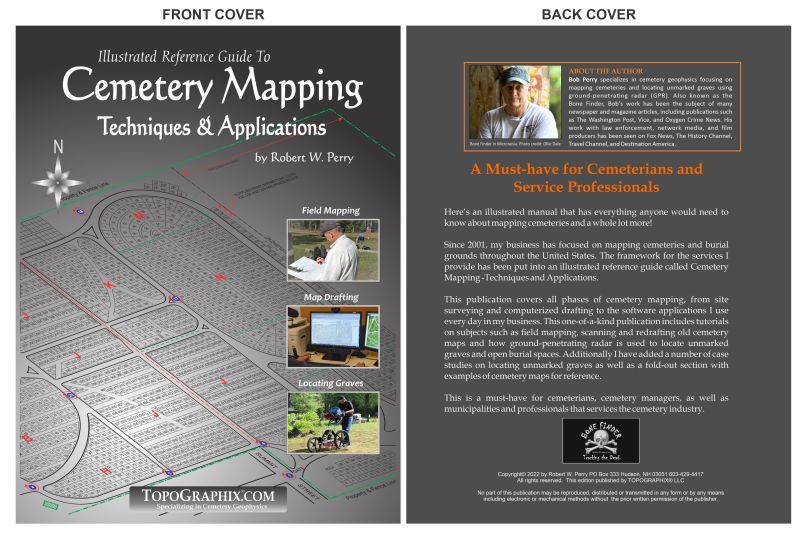

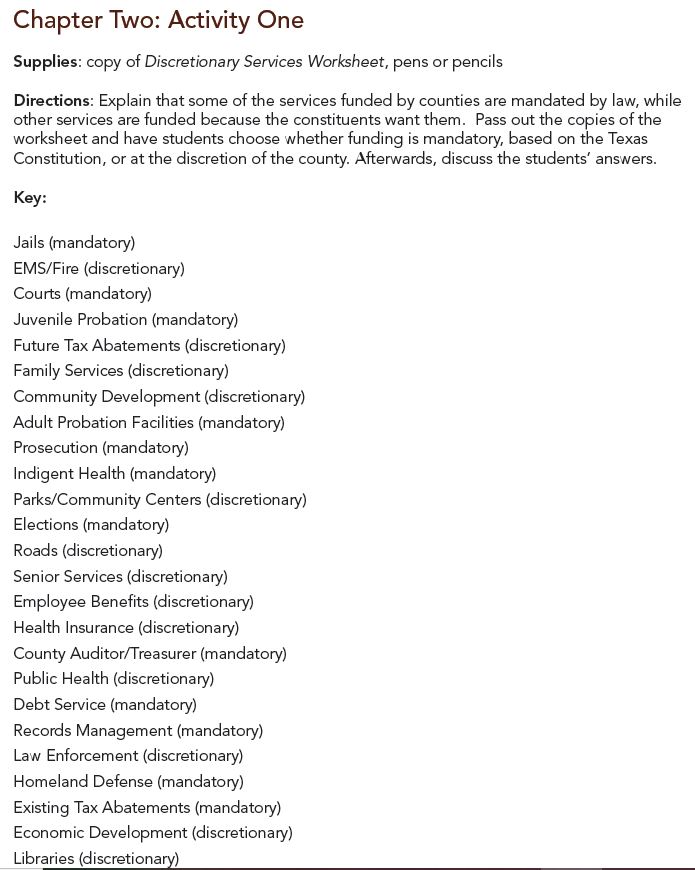

Back To School Basics - Discretionary Services Answers - Texas County Progress16 setembro 2024

Back To School Basics - Discretionary Services Answers - Texas County Progress16 setembro 2024 -

March of the Mini Beasts (1) (The DATA Set) by Hopper, Ada16 setembro 2024

March of the Mini Beasts (1) (The DATA Set) by Hopper, Ada16 setembro 2024 -

Curriculum & Instruction - Westside Union School District16 setembro 2024

Curriculum & Instruction - Westside Union School District16 setembro 2024 -

Epic Games Confirms The Next Season Of Fortnite Brings Players Back To Chapter 1 - Game Informer16 setembro 2024

Epic Games Confirms The Next Season Of Fortnite Brings Players Back To Chapter 1 - Game Informer16 setembro 2024 -

Tampa Bay – Tampa Bay NFL Alumni16 setembro 2024

Tampa Bay – Tampa Bay NFL Alumni16 setembro 2024 -

And just like that…..Back to School NYC📚✏️🍎! Sprinkle some of our special 'fairydust' on the new school year at Alice's!🧚✨🧚♀️ Our…16 setembro 2024

-

Alan F. Greene, PhD, RPA - Adjunct Professor of Social Studies and Anthropology - Bard High School Early College16 setembro 2024

você pode gostar

-

Frfr blueycapsules team got my back 🤝🤝 #blueycapsules #fnaf16 setembro 2024

-

Chloe Veitch From 'Too Hot to Handle' Is More Than Just a Reality Star16 setembro 2024

Chloe Veitch From 'Too Hot to Handle' Is More Than Just a Reality Star16 setembro 2024 -

como entrar no jogo dos homens na banheira roblox|Pesquisa do TikTok16 setembro 2024

como entrar no jogo dos homens na banheira roblox|Pesquisa do TikTok16 setembro 2024 -

Watch The Queen's Gambit16 setembro 2024

Watch The Queen's Gambit16 setembro 2024 -

denji (chainsaw man) drawn by punchingwater16 setembro 2024

denji (chainsaw man) drawn by punchingwater16 setembro 2024 -

Pin em Парные авы16 setembro 2024

Pin em Парные авы16 setembro 2024 -

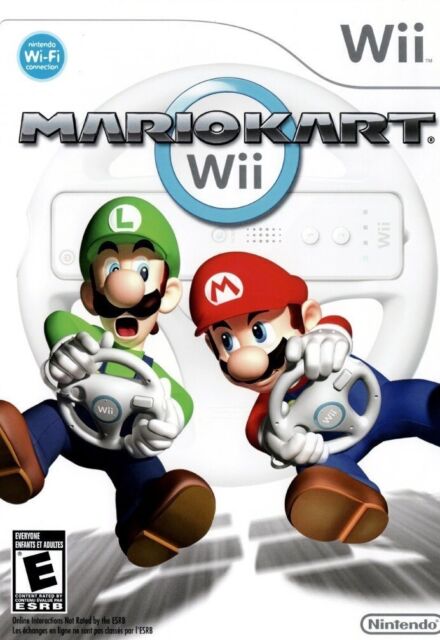

Preços baixos em Jogos de videogame de corrida16 setembro 2024

Preços baixos em Jogos de videogame de corrida16 setembro 2024 -

Trailer do anime de Kage no Jitsuryokusha ni Naritakute legendado16 setembro 2024

-

O Orlando Magic Game é a sua partida de basquete - Florida Mais!16 setembro 2024

O Orlando Magic Game é a sua partida de basquete - Florida Mais!16 setembro 2024 -

Tate no yusha no nariagari 20 The Rising of the Shield Hero16 setembro 2024

Tate no yusha no nariagari 20 The Rising of the Shield Hero16 setembro 2024